Housing Loan: Simple steps to become a landlord in Nigeria

Are you searching for housing loan facilities in Nigeria? Then take time to digest this information on simple steps you can take to become a landlord in Nigeria.

This is a follow up to my last article on real estate in Nigeria. The information is from the Mortgage help desk of Realty Point Limited supported by Platinum Savings & Loan Limited.

It's a simple step on how you can use the National Housing Fund Loan Scheme to purchase or renovate a residential accommodation.

What is the National Housing Fund Scheme? It's a scheme introduced by the Federal government of Nigeria to facilitate the continuous flow of low-cost funds for long term housing fund for the benefit of all Nigerians.

Nigerians are expected to contribute 2.5% of their monthly salary to Federal Mortgage Bank of Nigeria. It does not matter if you are self-employed or you own your own business, trader, artisan, professional, business person, etc.

Active members can get maximum of N5 million at the rate of 6% interest repayable over a period of 30 years after they have been contributing for a period of not less than one year.

The pool of contributions is to give housing loan for all Nigerians at relatively low rate of interest. To have access to the loan you must be a contributor.

The interest rate applicable at the time you obtain the loan will remain fixed until the loan is fully repaid. If you are not yet registered, it is required you pay in arrears of 3 years.

Here are the requirements to benefit from the housing Loan scheme:

- Evidence of registration with NHF Scheme (Pass-book).

- Income statement (pay slip for past 3 months).

- Tax clearance certificate for the past 3 years.

- Offer/Acceptance letter from developers/sellers after payment of personal intake (20%).

- Title document for the proposed building.

- Opening of account with Platinum Savings & Loan Ltd. (with a minimum of N25,0000.

- Legal fee to FMBN at N10,000.

- 8. Submission of valuation report.

- Application form from Estate Developer at N10,000.

- Seven copies of recent passport photograph.

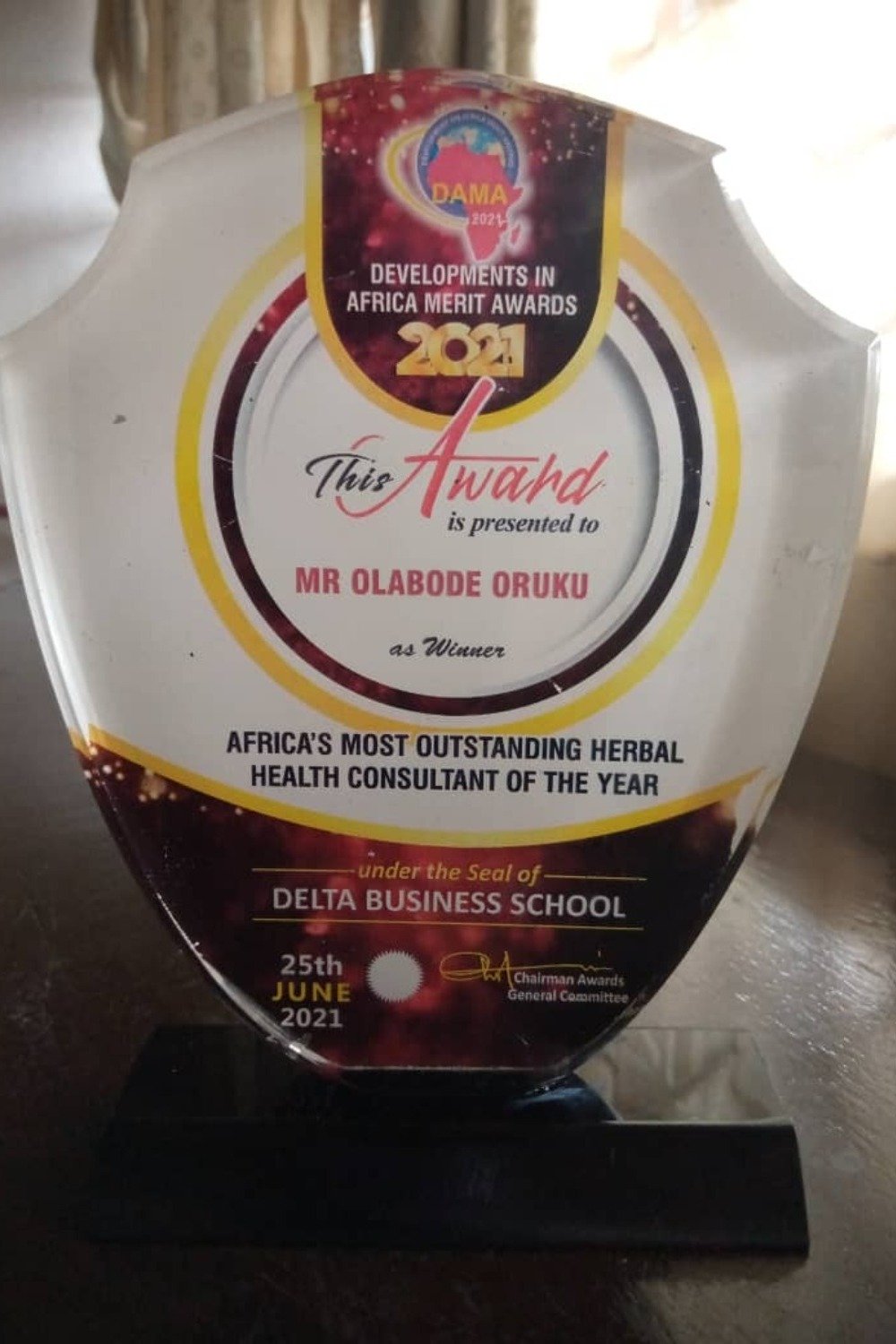

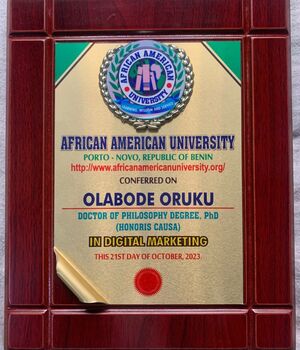

The 4 Options To Buy Kedi Herbal Products Or Open A Membership Account With N12,000 and enjoy members' benefits are:

1. If you’re in Lagos, Call/Text/WhatsApp number 2348121325411 or Call/Text/Telegram 2348033205456 for our office address.

2. People outside Lagos should call/Text/WhatsApp number 2348121325411 or Call/Text/Telegram 2348033205456 for the address of the Kedi Service Centre in their states, if available, and buy products and enjoy member prices using Kedi No: KN205898 and Names: Olabode Oruku. You can contact us to request your current membership number for product purchases.

3. It depends on your location if you want dispatch riders to deliver products to your house address within Lagos State for N2,000 and N6,000. Call/Text/WhatsApp number 2348121325411 or Call/Text/Telegram 2348033205456.

4. We deliver products outside Lagos with either Courier Companies or Transporters for a cost from N2,000 upward with cash on delivery.

Kedi Healthcare Price List From 1ST September 2023

P.S. We do recommend detoxification of the body system before any treatment to enhance result. The supplements for detoxification generally are Colon Cleanse tea, Constilease, Gastrifort, Refresh tea and Qinghao.

🌿 Boost Your Health. Grow Your Income. It Starts Here — Free!

Subscribe to NigeriaWeb Success Newsletter for The Health & Wealth Success Insider tips made for Nigerians.

Return to Nigeriaweb Success Home